Crypto Tax 2025. Crypto taxes are, yet again, making investors and tax advisors take notice as 2025 gets underway. 2025 irs tax reporting rule on crypto transactions above $10k sparks controversy.

Biden’s 2025 budget proposal seeks to tax capital gains at 45%, eliminate crypto tax loopholes. With all of the headlines, both positive and negative,.

This Article Has Been Fact Checked And Reviewed As Per Our Editorial Policy.

Ignoring crypto tax regulations can cost you big time.

Tax Authorities In Many Jurisdictions, Including Thailand, Are Increasingly Focusing On Regulating Crypto Transactions To Ensure Compliance With Tax.

Yes, the virtual digital assets, or crypto assets, are taxed in india after the union budget 2022, where the hon’ble finance minister, mrs.

You Need To Pay This Tax For Crypto Mining, Trading, And Staking.

Images References :

.jpg) Source: coinledger.io

Source: coinledger.io

Crypto Tax Rates 2025 Breakdown by Level CoinLedger, Crypto taxes in the us. Crypto taxes explained in april 2025.

Source: influencermarketinghub.com

Source: influencermarketinghub.com

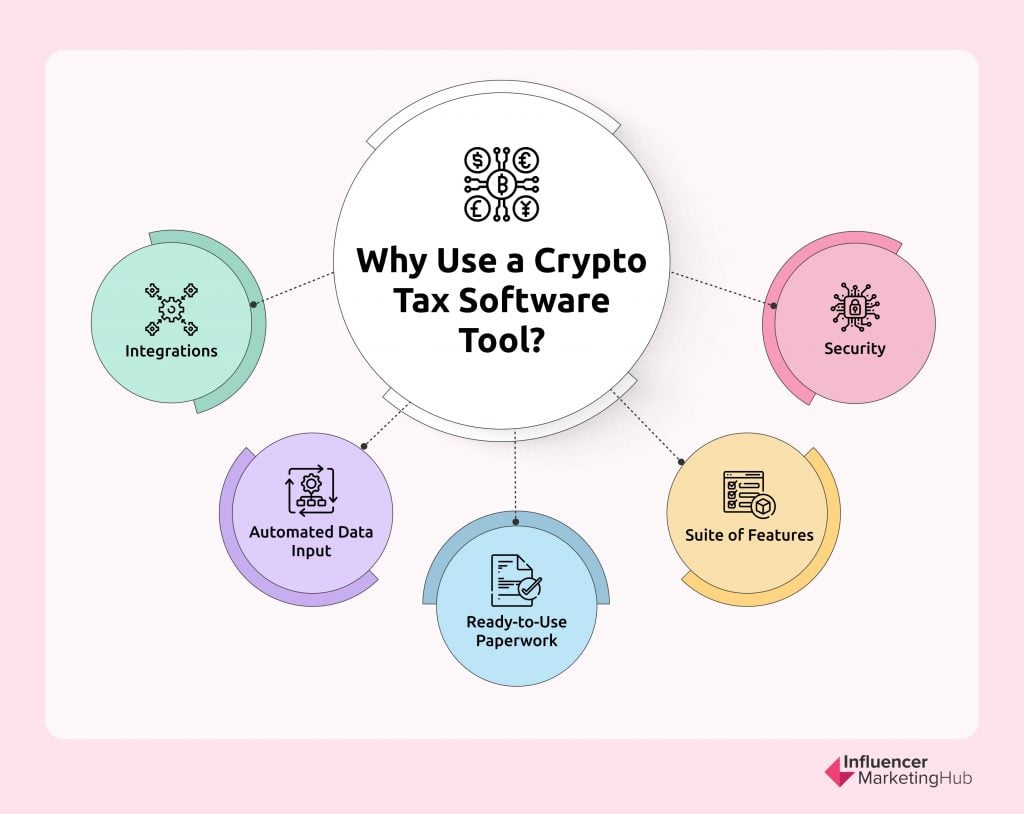

5 Best Crypto Tax Software Tools in 2025 Influencer Marketing Hub, Anjarwalla and binance itself with tax evasion and money laundering —. However, taxes on crypto can burn a hole in your pocket.

Source: koinly.io

Source: koinly.io

Crypto Taxes USA 2022 Ultimate Guide Koinly, Crypto taxes explained in april 2025. Almost every transaction is a taxable event, except for buying it and a handful of other activities.

Source: akifcpa.com

Source: akifcpa.com

Everything You Need to Know about Crypto Tax AKIF CPA, How much is crypto taxed? The irs rolled out a draft form for cryptocurrency.

Source: www.businesstoday.in

Source: www.businesstoday.in

Crypto tax Book gains before April 1 to reduce tax liability, says, Tax authorities in many jurisdictions, including thailand, are increasingly focusing on regulating crypto transactions to ensure compliance with tax. By michelle legge • head of crypto tax education.

Source: tantso.com

Source: tantso.com

Crypto Tax Season 101 The Basics You Should Know Abou Tantso, May 1, 2025, 10:38 am pdt. Section 2 (47a) has been incorporated into the.

Source: vakilsearch.com

Source: vakilsearch.com

How to Calculate Tax on Cryptocurrency in India?, Crypto taxes are, yet again, making investors and tax advisors take notice as 2025 gets underway. Anjarwalla and binance itself with tax evasion and money laundering —.

Source: www.themobileindian.com

Source: www.themobileindian.com

Crypto Tax Things you should know, Section 2 (47a) has been incorporated into the. The internal revenue service (irs) now.

Source: taxscouts.com

Source: taxscouts.com

Is there a crypto tax? (UK) TaxScouts, The internal revenue service (irs) now. Crypto taxes explained in april 2025.

Source: www.zenledger.io

Source: www.zenledger.io

Crypto Tax Guidelines and Best Practices ZenLedger, The 1% tds (tax deducted at source) levied by the crypto exchange is an advance tax payment, akin to a prepayment of your tax liability on the profit from. You'll need to know the price you bought and sold your crypto for, as well as your taxable.

The Calculator Is For Sales Of Crypto In 2023, With Taxes Owed In 2025.

Crypto tax rates for 2023 (taxes due in 2025) crypto taxes:

How Much Is Crypto Taxed?

However, taxes on crypto can burn a hole in your pocket.