Maximum Interest Rate By State 2024. On consumer transactions, the maximum rate of interest for the first $1,000 is 18%, above $1,000 is 14.45%. $ 1,161 your estimated monthly payment.

Your amount could be different depending on: Colorado has passed a law that amends the colorado uniform consumer credit code (uccc) to extend state interest rate limits on certain consumer loans made.

This Publication Lists The Benefit Rates And Pension Rates For 2024 To 2025 As Set Out In The Written Ministerial Statement Made By The Secretary Of State For Work And.

Usury laws may not always apply to maximum interest rates for different types of loans.

The Maximum Late Fee Is 10% Of The Overdue Balance Per Month.

Many states set different rate caps on small loans based on the loans’ size and repayment term.

The Maximum Rate Of Interest Is Set At 10%.

Municipalities may, by vote, determine the rate of interest that shall apply to taxes that become delinquent during a particular taxable year until those taxes.

Images References :

Source: www.newcapitalmgmt.com

Source: www.newcapitalmgmt.com

200 Years of Interest Rates in the U.S. — The New Capital Journal — New, Variable (see notes) the interest rate for usury judgements in massachusetts can be either 12% or 18%, depending upon we. Colorado has passed a law that amends the colorado uniform consumer credit code (uccc) to extend state interest rate limits on certain consumer loans made.

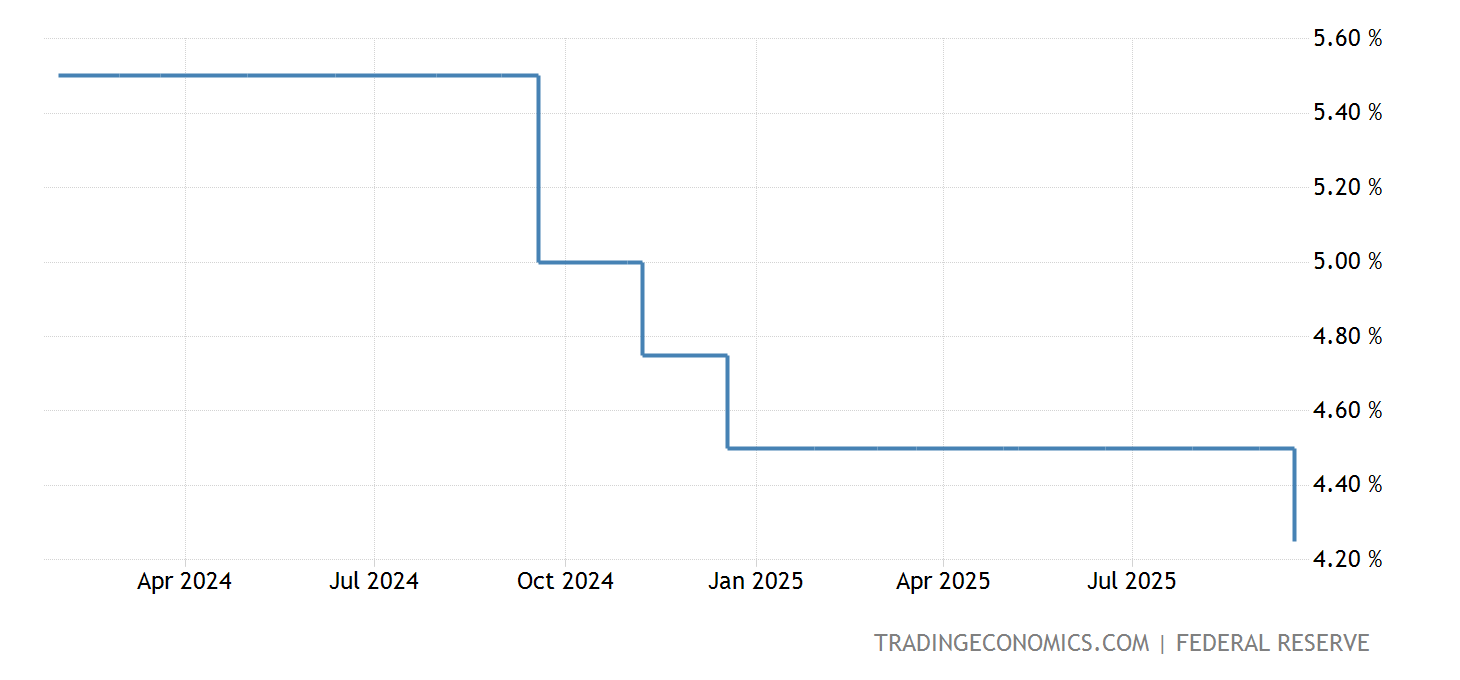

Source: es.tradingeconomics.com

Source: es.tradingeconomics.com

Estados Unidos Tasa de Interés 19712022 Datos 20232024 Expectativa, Pursuant to 13 cfr 120.921 (b), the maximum legal interest rate for any third party lender's commercial loan which funds any portion of the cost of a 504 project (see 13. Every change in rate means savings or costs for homebuyers.

Source: www.prnewswire.com

Source: www.prnewswire.com

Study Finds the Best Interest Rate in All 50 States, For the most part, loan rates are controlled at the state level. A grace period is not required, but a.

Source: www.gzeromedia.com

Source: www.gzeromedia.com

The Graphic Truth 50 years of US inflation vs interest rates GZERO Media, Consumer transactions are governed at a maximum rate of 12%. Usury laws may not always apply to maximum interest rates for different types of loans.

Source: www.interest.co.nz

Source: www.interest.co.nz

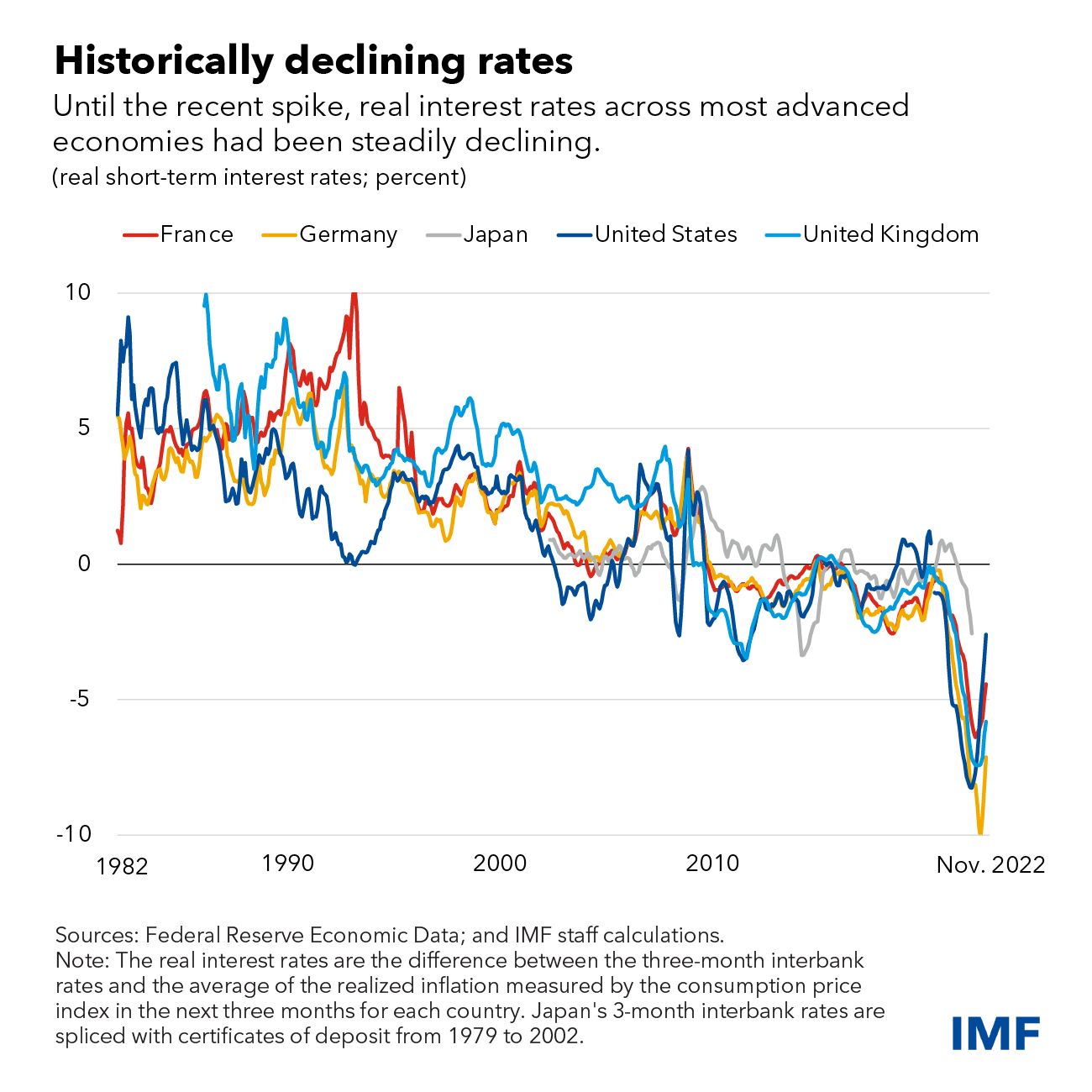

Interest rates are likely to return toward prepandemic levels when, Tax rate paid by individuals, personal representatives (prs) and trusts for disabled: Usury laws may not always apply to maximum interest rates for different types of loans.

Source: forestparkgolfcourse.com

Source: forestparkgolfcourse.com

Current Mortgage Interest Rates October 2022 (2023), Municipalities may, by vote, determine the rate of interest that shall apply to taxes that become delinquent during a particular taxable year until those taxes. On consumer transactions, the maximum rate of interest for the first $1,000 is 18%, above $1,000 is 14.45%.

Source: investing-abc.com

Source: investing-abc.com

Debt Cycles How They Work and How To Use Them InvestingABC, The full rate of new state pension is £203.85 a week. Each week there will be 20 prizes of €1,000 and 20 prizes of €500 respectively, the remaining weekly prize fund.

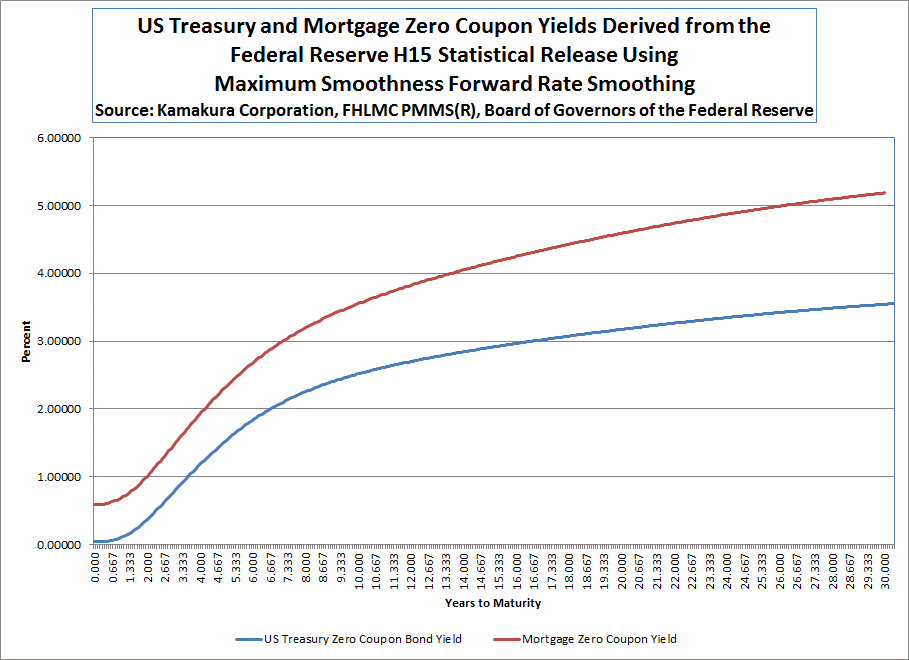

Source: seekingalpha.com

Source: seekingalpha.com

Forward Fixed Rate Mortgage Yields Up 0.01 In 2024 From Last Week, The legal rate of interest is 10%; A grace period is not required, but a.

Source: www.hechtgroup.com

Source: www.hechtgroup.com

Hecht Group Mortgage Rates For Commercial Property In The United States, See your state’s maximum loan apr. For the most part, loan rates are controlled at the state level.

Source: wowa.ca

Source: wowa.ca

2024 Mortgage Rates Forecast (Updated June 27, 2023) WOWA.ca, Consumer transactions are governed at a maximum rate of 12%. The specifics often differ between states.

If You Were Contracted Out Before 2016.

Consumer transactions are governed at a maximum rate of 12%.

For Instance, If You’re In South Carolina, The Legal Maximum Rate Of Interest Is Set At 8.75 Percent, But At 18 Percent For Credit Card Debt.

A grace period is not required, but a.

A Usury Law Is Essentially An Interest Rate Law.

Many states set different rate caps on small loans based on the loans' size and repayment term.